Homeowners Insurance in and around Wynne

A good neighbor helps you insure your home with State Farm.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

It's so good to be home, especially when your home is covered by State Farm. You never have to be afraid of the unexpected with this excellent insurance.

A good neighbor helps you insure your home with State Farm.

Apply for homeowners insurance with State Farm

Protect Your Home With Insurance From State Farm

Preparing for life's troubles is made easy with State Farm. Here you can build the right plan or submit a claim with the help of agent Meredith Peeler. Meredith Peeler will make sure you get the thoughtful, dependable care that you and your home needs.

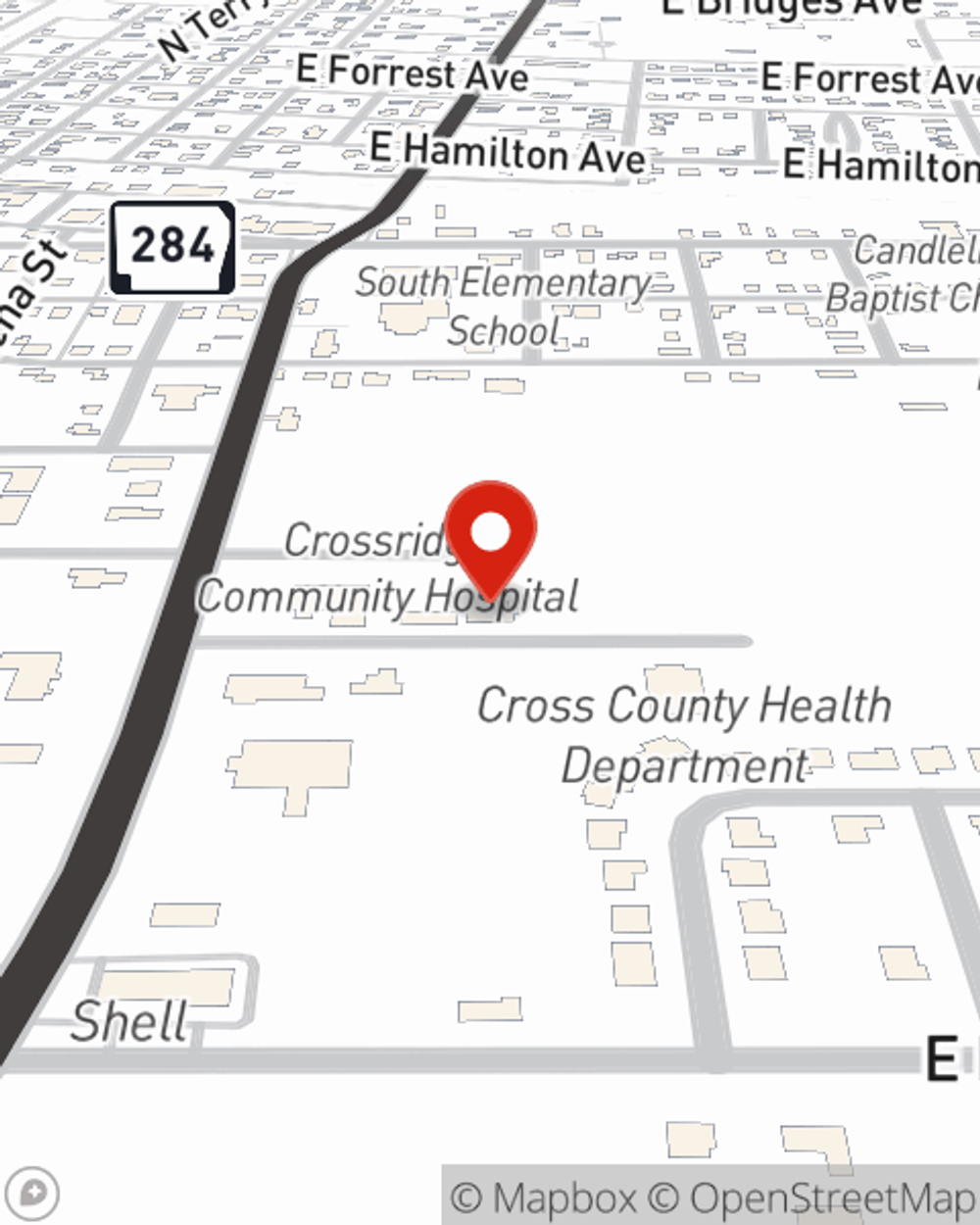

Wynne, AR, it's time to open the door to secure coverage. State Farm agent Meredith Peeler is here to assist you in getting started. Contact today!

Have More Questions About Homeowners Insurance?

Call Meredith at (870) 238-3800 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to keep birds away from your house

How to keep birds away from your house

If birds or geese are a problem in your yard, becoming a nuisance to you and your family, these deterrent tips may help you keep unfriendly fowl at bay.

Ways to help add value to your home

Ways to help add value to your home

Discover new ways to get the most home value, from complete home renovations to simple improvements.

Meredith Peeler

State Farm® Insurance AgentSimple Insights®

How to keep birds away from your house

How to keep birds away from your house

If birds or geese are a problem in your yard, becoming a nuisance to you and your family, these deterrent tips may help you keep unfriendly fowl at bay.

Ways to help add value to your home

Ways to help add value to your home

Discover new ways to get the most home value, from complete home renovations to simple improvements.